Just a few weeks ago Donald Trump became America’s 45th president. Judging by his first two weeks, I can say that his presidency brings uncertainty and chaos. Uncertainty and chaos, are exactly what the markets love to hate. If you add to that the weak dollar, then you have the perfect recipe for gold. You see, the weak dollar and political uncertainty favor gold.

Uncertainty cannot be planned for, cannot be predicted-can only be estimated, and can be wildly and unexpectedly wrong.

The United States economy is the biggest economy in the world, it has the biggest GDP in the world. (16.77trillion) It also has the biggest debt in the world. (17.60trillion)

Because of this difference in size, most people think it’s insulated from the actions of the world economic climate. In addition, the dollar is the world’s reserve currency of choice, and America has been used to have the first word, on many fronts economically.

However, this is about to change.

In recent years, the gap between government income and expenditure has widened due to the degree of military service, and social security commitments, and at the same time, productivity and educational levels, is where its fallen behind.

Without radical change, this gap could reach a point of no return. In this case, the dollar will weaken to a degree unseen in recent years.

At the same time, Russia and China are teaming up in their efforts to replace the dollar, as the world’s reserve currency. And this is possible due to changes in the IMF’s voting system. The BRICS (Russia, India, Brasil, China, and Sth. Africa) have now collectively more votes than the US alone. That means the dollar will soon be in danger unless the Trump administration decides to reform the US financial system.

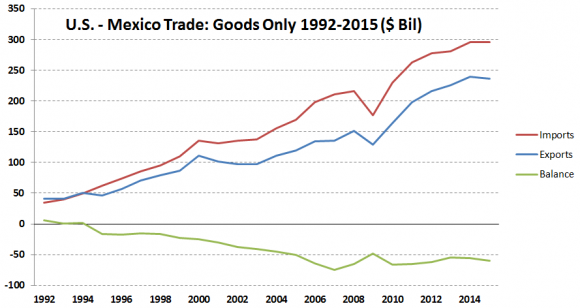

In addition, when it comes to the US balance of trade, the news isn’t good either. The trade deficit for the year 2016 was $502.25 billion, a 0,4% from the year 2015. This will also weaken the position of the US dollar role, as the world’s reserve currency.

It is imperative that you preserve the value of the things you have and I am talking about your savings. Rather than investing in bonds, shares, and other paper holdings, I suggest that you invest in gold. In this case, when you do come to draw down the money, there will be far more to take. That is the whole idea behind it.

Remember investing in physical gold hedges you against inflation, and protects you if the dollar collapses.